Choosing the right credit card processor is essential for businesses in the US to handle payments efficiently and securely. The top credit card processors offer reliable transaction speeds, competitive fees, and strong customer support.Top Credit Card Processors in US combine ease of use, affordability, and robust security features to meet diverse business needs, enabling smooth payment experiences for both merchants and customers.Understanding which credit card processor fits a business’s size and industry helps optimize payment acceptance. The following analysis highlights key providers leading the market.

Top Credit Card Processors in the US

Credit card processors in the US vary based on transaction fees, service quality, and system compatibility. Understanding the strengths and limitations of each helps businesses select the best option for their needs.

Leading Payment Processing Companies

The top processors include Square, Stripe, PayPal, Fifth Third Bank, and Worldpay. Square is favored for its flat-rate pricing and ease of use in small businesses. Stripe excels with customizable APIs, preferred by tech-savvy companies.PayPal offers vast consumer familiarity and strong online payment options. Fifth Third Bank provides solid merchant services with business banking integration. Worldpay supports global transactions with flexible pricing for high-volume merchants.

Comparison of Features and Pricing

Square charges 2.6% + 10¢ per swipe, with no monthly fees, making it attractive for small sales volumes. Stripe’s fees start at 2.9% + 30¢ per transaction and include advanced tools for developers.PayPal’s rates are similar but add fees for currency conversion. Fifth Third Bank typically offers negotiated rates, which may benefit larger businesses. Worldpay has tiered pricing models that vary with volume and service levels.

| Processor | Transaction Fee | Monthly Fee | Special Feature |

| Square | 2.6% + 10¢ swipe | $0 | Simple pricing, free POS |

| Stripe | 2.9% + 30¢ online | $0 | Custom APIs, developer tools |

| PayPal | 2.9% + 30¢ | $0 | Buyer protection, wide use |

| Fifth Third | Negotiated rates | Varies | Banking integration |

| Worldpay | Tiered, volume-based | Varies | Global payment support |

Merchant Support and Service Quality

Customer service quality varies widely. Square offers 24/7 support and a comprehensive online knowledge base. Stripe provides developer-focused support with community forums and phone assistance for premium users.PayPal’s support is accessible but reported response times can be inconsistent. Fifth Third Bank includes dedicated merchant support and local banking relationships. Worldpay delivers around-the-clock global support but may require higher fees for premium service.Response speed and problem resolution are critical, especially for businesses processing high sales volumes.

Integration with Ecommerce and POS Systems

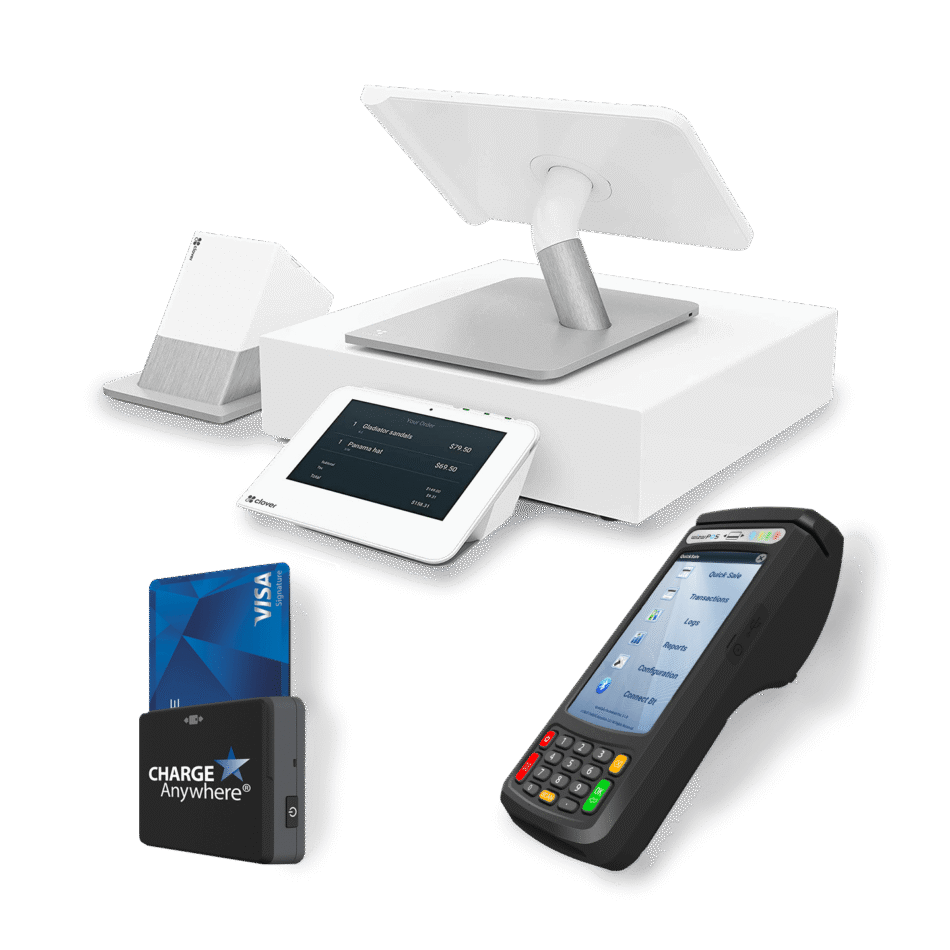

Stripe integrates seamlessly with most ecommerce platforms like Shopify, WooCommerce, and Magento. Its API allows custom payment experiences.Square provides built-in POS hardware and software, excellent for physical retailers and restaurants. PayPal supports easy checkout buttons and mobile payments but less POS hardware.Fifth Third Bank offers integration with major POS providers but is less flexible for custom setups. Worldpay connects well to both ecommerce and in-store systems, supporting omnichannel businesses with advanced options.

How to Choose the Right Credit Card Processor

Selecting a credit card processor requires careful consideration of pricing structures, security measures, and the ability to support growth. Each factor shapes payment efficiency and business sustainability.

Understanding Processing Fees and Contracts

Processing fees vary by provider and directly impact profit margins. Typical fees include a percentage of the transaction value plus a fixed amount per transaction.Contracts may be monthly or annual, with some requiring long-term commitments. Early termination fees and hidden charges, such as PCI compliance fees or statement fees, can incur unexpected costs.Businesses should compare interchange fees, gateway fees, and any additional costs like chargeback fees. Transparent fee structures help avoid surprises and enable accurate budgeting.

Security and Compliance Standards

A credit card processor must adhere to PCI-DSS (Payment Card Industry Data Security Standard) to protect cardholder data. Compliance minimizes risks of data breaches and fines.Look for end-to-end encryption and tokenization features. These technologies secure transaction data during processing and storage.Processors that provide real-time fraud detection and alert tools help businesses react fast to suspicious activities. This reduces financial loss and protects customer trust.

Scalability for Businesses of Different Sizes

Processors should support various transaction volumes without degrading service quality. Flexible plans allow businesses to scale from small startups to large enterprises.Features like multi-location support, customizable point-of-sale integrations, and multi-currency acceptance enable growth into different markets.Businesses expecting seasonal spikes or rapid expansion benefit from scalable processing limits and adaptable pricing models. This ensures efficient, cost-effective transaction handling as needs evolve.