Introduction

The barrier films market represents one of the most dynamic and rapidly evolving sectors within the global packaging industry. These specialized films serve as protective barriers against moisture, oxygen, light, and other environmental factors that can compromise product quality and shelf life. From preserving the freshness of your morning coffee to protecting sensitive electronic components in smartphones, barrier films have become indispensable in countless applications across diverse industries.

Barrier films are thin polymer layers designed with specific properties that prevent the transmission of gases, vapors, and other substances. Unlike conventional packaging materials, these films are engineered at the molecular level to create selective barriers that allow certain substances to pass through while blocking others. This sophisticated functionality makes them crucial for applications ranging from food preservation to pharmaceutical protection and advanced electronics manufacturing.

The importance of barrier films extends far beyond simple packaging. In the food industry, they help reduce food waste by extending product shelf life, contributing to global sustainability efforts. In pharmaceuticals, they ensure medication efficacy by protecting against moisture and oxidation. In electronics, they enable the development of flexible displays and solar cells by providing protection against environmental degradation.

The market encompasses various types of films including metalized films, oxide-coated films, and organic barrier coatings, each designed for specific applications and performance requirements. The versatility of these materials has led to their adoption across sectors including food and beverage, pharmaceuticals, electronics, agriculture, and industrial applications.

The Evolution of Barrier Films Technology

The journey of barrier films began in the early 20th century with the development of cellophane, one of the first transparent packaging materials. Initially used for wrapping candies and other confections, cellophane provided a clear view of products while offering basic protection against contamination. The material gained popularity during World War II when it became essential for protecting military supplies and equipment from harsh environmental conditions.

The 1950s marked a significant turning point with the introduction of polyethylene and polypropylene films. These materials offered improved barrier properties and greater durability compared to earlier options. Manufacturers began experimenting with different polymer combinations to create films with enhanced performance characteristics. The development of oriented polypropylene (OPP) and polyethylene terephthalate (PET) films provided better mechanical strength and barrier properties.

The 1970s witnessed the emergence of multilayer films through co-extrusion technology. This innovation allowed manufacturers to combine different polymer layers, each contributing specific properties to the final product. Ethylene vinyl alcohol (EVOH) became a game-changer during this period, offering exceptional oxygen barrier properties that made it ideal for food packaging applications requiring extended shelf life.

Metallization technology emerged in the 1980s, introducing aluminum-coated films that provided superior barrier performance. These metalized films offered excellent protection against light, oxygen, and moisture while maintaining flexibility and processability. The technique involved depositing a thin layer of aluminum onto plastic substrates, creating films with metallic appearance and enhanced barrier properties.

The 1990s brought advances in transparent barrier films through the development of silicon oxide (SiOx) coating technology. This innovation enabled the production of clear films with excellent barrier properties, addressing applications where product visibility was important. Silicon oxide coatings provided near-metallic barrier performance while maintaining transparency.

Nanotechnology revolutionized barrier films in the 2000s. The incorporation of nanoparticles, particularly clay nanoparticles, created nanocomposite films with dramatically improved barrier properties. These materials offered enhanced performance at lower coating weights, reducing material costs while improving functionality.

Recent developments have focused on sustainable barrier films using bio-based polymers and recyclable materials. Manufacturers are developing films from renewable sources such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA). These biodegradable options address growing environmental concerns while maintaining performance standards.

Smart barrier films represent the latest frontier in technology evolution. These materials incorporate sensors and indicators that can monitor product conditions and provide real-time information about freshness, temperature exposure, and potential contamination. Some films can even respond to environmental changes by adjusting their barrier properties accordingly.

The integration of artificial intelligence and machine learning is driving the next generation of barrier film development. Advanced modeling techniques help predict material performance and optimize film structures for specific applications, reducing development time and improving cost-effectiveness.

Current Market Trends

The barrier films market is experiencing several transformative trends that are reshaping industry dynamics and driving innovation. Sustainability has emerged as the dominant trend, with companies investing heavily in developing eco-friendly alternatives to traditional barrier films. Consumers and regulatory bodies are demanding packaging solutions that minimize environmental impact while maintaining product protection standards.

Flexible packaging continues to gain market share as brands seek lighter, more efficient packaging solutions. The trend toward convenience foods and ready-to-eat meals has accelerated demand for high-performance barrier films that can withstand various processing conditions including microwave heating and extended storage periods.

E-commerce growth has created new requirements for barrier films. Online retailers need packaging that can protect products during shipping and storage in various environmental conditions. This has driven demand for films with enhanced puncture resistance and barrier properties that maintain effectiveness even after mechanical stress.

The pharmaceutical industry is increasingly adopting barrier films for drug packaging applications. Aging populations worldwide and the growth of specialty pharmaceuticals have created demand for packaging that can protect sensitive medications from moisture, oxygen, and light exposure. Personalized medicine and small-batch drug production have driven interest in flexible barrier film solutions that can accommodate varied packaging requirements.

Electronics manufacturers are embracing flexible barrier films for next-generation devices. Foldable smartphones, flexible displays, and wearable electronics require barrier films that can maintain protection while bending and flexing. The development of ultra-thin, flexible barrier films has enabled new product categories and design possibilities.

Active packaging incorporating barrier films is gaining traction across multiple industries. These systems can absorb oxygen, release antimicrobials, or indicate product freshness through color changes. Smart packaging solutions that combine barrier films with sensors and communication technologies are enabling new levels of supply chain visibility and consumer engagement.

High barrier performance requirements are pushing technological boundaries. Industries are demanding films with water vapor transmission rates measured in fractions of grams per square meter per day, driving innovation in coating technologies and multilayer film structures.

Customization and specialty applications are becoming increasingly important. Manufacturers are developing barrier films tailored to specific product requirements rather than offering one-size-fits-all solutions. This trend toward specialization is creating opportunities for niche players while challenging traditional mass-production approaches.

Regional preferences are influencing product development strategies. Asian markets favor transparent barrier films for food applications, while North American markets emphasize recyclability and sustainability features. European markets focus on regulatory compliance and environmental performance.

Challenges Facing the Barrier Films Market

The barrier films industry confronts numerous challenges that impact growth prospects and operational efficiency. Cost pressures represent a primary concern as raw material prices fluctuate and customers demand more affordable packaging solutions. Petroleum-based polymers, which form the backbone of most barrier films, are subject to oil price volatility that directly affects production costs.

Technical performance requirements continue to escalate across applications. Food manufacturers demand barrier films that can withstand high-temperature processing while maintaining structural integrity and barrier properties. Electronics manufacturers require films with extremely low water vapor transmission rates that approach theoretical limits of measurement capability.

Regulatory compliance presents ongoing challenges as governments worldwide implement stricter packaging regulations. The European Union’s single-use plastics directive has forced manufacturers to develop alternative materials while maintaining performance standards. Food contact regulations require extensive testing and certification processes that extend product development timelines and increase costs.

Recycling infrastructure limitations pose significant obstacles to sustainability goals. While manufacturers can develop recyclable barrier films, inadequate collection and processing systems limit actual recycling rates. The complexity of multilayer structures makes separation and recycling technically challenging and economically questionable in many regions.

Competition from alternative packaging technologies threatens market share in certain applications. Glass packaging is experiencing renewed interest for premium products, while paper-based solutions are gaining acceptance for applications where ultimate barrier performance is less critical. Metal packaging maintains advantages in specific high-barrier applications.

Supply chain disruptions have highlighted vulnerabilities in raw material sourcing and manufacturing operations. The COVID-19 pandemic exposed dependencies on single-source suppliers and geographically concentrated production facilities. Companies are now investing in supply chain resilience, which increases operational complexity and costs.

Environmental concerns extend beyond recyclability to include carbon footprint considerations. Life cycle assessments are revealing the environmental impact of barrier film production, transportation, and disposal. Companies must balance performance requirements with sustainability goals while maintaining cost competitiveness.

Quality control challenges arise from the increasing sophistication of barrier film structures. Multilayer films with nanometer-thick coatings require advanced testing equipment and procedures to ensure consistent performance. Defect detection becomes more difficult as barrier layers become thinner and more complex.

Skilled workforce shortages affect both manufacturing operations and research and development activities. The specialized knowledge required for barrier film development and production is not readily available in the general labor market. Companies must invest in training programs and compete for limited talent pools.

Market fragmentation creates challenges for standardization and scale economies. Different applications require unique material properties, preventing manufacturers from achieving optimal production volumes for individual products. This fragmentation limits opportunities for cost reduction through economies of scale.

Intellectual property considerations complicate technology development and licensing arrangements. Key technologies are often protected by multiple overlapping patents, creating complex licensing landscapes that can restrict innovation or increase development costs.

Market Scope and Applications

The barrier films market encompasses an extensive range of applications across diverse industry sectors, each with unique performance requirements and growth dynamics. The food and beverage industry represents the largest application segment, utilizing barrier films for packaging products ranging from snack foods to liquid beverages. These applications require films that can prevent oxygen transmission to maintain freshness, block moisture to prevent spoilage, and resist grease penetration for oily products.

Fresh produce packaging utilizes specialized barrier films that can regulate gas exchange to extend shelf life while preventing moisture loss. Modified atmosphere packaging systems rely on barrier films to maintain optimal gas compositions around perishable products. Frozen food applications demand films that maintain barrier properties at low temperatures while resisting cracking and brittleness.

Pharmaceutical packaging represents a high-value market segment with stringent performance requirements. Barrier films protect medications from moisture, oxygen, and light exposure that could compromise drug efficacy. Blister packaging for tablets and capsules utilizes thermoformable barrier films that can withstand forming operations while maintaining protective properties. Flexible pouches for powder medications require films with exceptional moisture barrier performance.

Electronics manufacturing has emerged as a rapidly growing application area for barrier films. Organic light-emitting diode (OLED) displays require barrier films with water vapor transmission rates measured in millionths of a gram per square meter per day. Flexible electronics applications demand films that maintain barrier properties while being bent, stretched, or twisted repeatedly. Solar cell encapsulation utilizes barrier films to protect photovoltaic materials from environmental degradation.

Agricultural applications utilize barrier films for crop protection and greenhouse covering materials. These films must balance light transmission with barrier properties to create optimal growing environments while protecting against pests and diseases. Mulch films incorporate barrier properties to control soil moisture and prevent weed growth.

Industrial applications encompass a broad range of uses including chemical packaging, component protection, and temporary barriers during construction or manufacturing processes. These applications often require films with resistance to specific chemicals or extreme environmental conditions.

Personal care and cosmetics packaging increasingly relies on barrier films to protect product formulations from oxidation and contamination. Flexible tubes and pouches for creams, lotions, and other products require films that prevent ingredient migration while maintaining package integrity.

Pet food packaging has evolved to incorporate high-performance barrier films that preserve nutritional value and prevent rancidity in high-fat content products. The growing premium pet food market demands packaging performance similar to human food applications.

Medical device packaging utilizes barrier films for sterile packaging applications where products must remain sterile until use. These applications require films that can withstand sterilization processes while maintaining barrier integrity and allowing sterile access when needed.

Building and construction applications include barrier films for moisture control in walls and foundations, temporary weather protection during construction, and permanent vapor barriers in building systems. These applications require films with long-term durability and resistance to environmental stress.

Market Size and Growth Projections

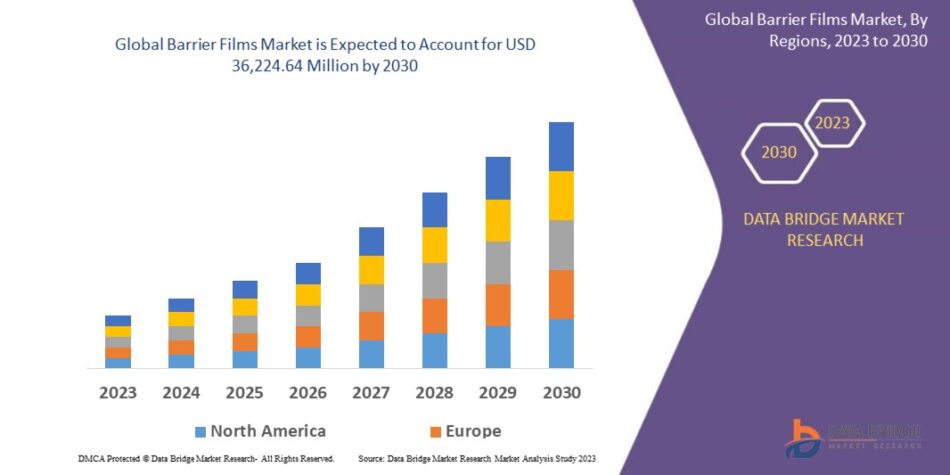

The global barrier films market demonstrates robust growth trajectory with multiple research organizations providing convergent forecasts for sustained expansion. Current market valuations indicate a substantial industry base with strong fundamentals supporting continued growth across all major application segments and geographic regions.

Market research indicates the global barrier films market achieved a valuation of approximately $23.7 billion in 2022, with projections suggesting growth to $36.2 billion by 2030, representing a compound annual growth rate of 5.42%. Alternative research methodologies project even more optimistic scenarios, with some analyses forecasting market expansion to $64.1 billion by 2034 at a 5.9% compound annual growth rate.

The high barrier packaging films segment, representing a premium market category, demonstrates particularly strong growth dynamics. This segment is projected to expand from $8.52 billion in 2025 to $11.46 billion by 2030, achieving a compound annual growth rate of 6.12%. Alternative projections for high barrier packaging films suggest a market value of $19.3 billion in 2025, anticipated to reach $28.3 billion by 2035 with a 3.9% compound annual growth rate.

Regional market analysis reveals significant variations in growth rates and market characteristics. The Asia Pacific region demonstrates the strongest growth potential, with high barrier packaging films expected to register a compound annual growth rate of 11.61% from 2025 through 2032. This exceptional growth reflects rapid industrialization, urbanization, and rising disposable incomes across major Asian economies.

North America maintains its position as a mature market with steady growth expectations. The region is projected to achieve a compound annual growth rate of 4.9% over the forecast period, supported by strong demand from food processing, pharmaceuticals, and electronics manufacturing sectors. Market maturity in North America creates opportunities for premium products and specialty applications.

European markets focus on sustainability and regulatory compliance, driving demand for eco-friendly barrier film solutions. While growth rates may be more moderate compared to developing regions, the emphasis on high-value applications and environmental performance supports market expansion and profitability.

The flexible electronics barrier films segment represents a rapidly emerging market with exceptional growth potential. This specialized segment achieved a valuation of $48.71 million in 2024 and is projected to reach $234.88 million by 2033, registering a remarkable compound annual growth rate of 19.1%. This growth reflects the expanding adoption of flexible displays, wearable electronics, and organic photovoltaic devices.

Application-specific market segments show varied growth patterns reflecting industry dynamics and technological advancement. Food packaging applications continue to represent the largest market share while maintaining steady growth rates. Pharmaceutical packaging demonstrates above-average growth driven by aging populations and increased healthcare spending. Electronics applications show the highest growth rates despite smaller current market size.

Market concentration analysis indicates a fragmented industry structure with numerous regional and specialty players competing alongside major multinational corporations. This fragmentation creates opportunities for innovation and specialization while limiting individual company market share. Consolidation activities may increase as companies seek to achieve scale economies and broaden product portfolios.

Investment flows into barrier film technology development and manufacturing capacity expansion support optimistic growth projections. Companies are committing significant resources to research and development activities focused on next-generation barrier technologies and sustainable material alternatives.

Factors Driving Market Growth

Multiple interconnected factors contribute to the robust growth trajectory of the barrier films market, creating a synergistic environment that supports sustained expansion across applications and regions. The fundamental driver stems from increasing global food production and the need to reduce food waste through improved packaging technologies.

Population growth and urbanization create expanding markets for packaged foods and consumer products requiring barrier film protection. Urban consumers increasingly rely on packaged foods for convenience and time savings, driving demand for barrier films that can extend shelf life and maintain product quality during distribution and storage.

Rising disposable incomes, particularly in emerging economies, enable consumers to purchase premium products with sophisticated packaging requirements. This economic development supports demand for high-performance barrier films that provide superior protection and enhanced product presentation.

E-commerce expansion has fundamentally altered packaging requirements across product categories. Online retailers require packaging that can protect products during extended shipping times and varied handling conditions. Barrier films provide essential protection against moisture, temperature fluctuations, and physical damage during e-commerce fulfillment processes.

Healthcare sector expansion drives demand for pharmaceutical packaging applications. Aging populations worldwide increase medication consumption while specialty pharmaceuticals require sophisticated barrier protection. Personalized medicine trends create opportunities for flexible barrier film solutions that can accommodate small-batch production requirements.

Electronics industry innovation continuously creates new applications for barrier films. The development of flexible displays, wearable devices, and organic electronics requires barrier films with unprecedented performance levels. 5G technology deployment and Internet of Things device proliferation expand the market for electronic components requiring barrier protection.

Sustainability concerns drive innovation in eco-friendly barrier film technologies. Consumer preferences and regulatory requirements support development of biodegradable, compostable, and recyclable barrier films. Companies investing in sustainable solutions gain competitive advantages and access to environmentally conscious market segments.

Food safety regulations worldwide mandate improved packaging standards that often require barrier film technologies. Government initiatives to reduce foodborne illness and extend shelf life support market expansion through regulatory requirements and industry best practices.

Supply chain globalization increases the need for packaging that can protect products during extended transportation and storage periods. International trade requires barrier films that maintain effectiveness across varied climate zones and handling conditions.

Technological advancement continues to improve barrier film performance while reducing costs. Nanotechnology integration, advanced coating techniques, and smart packaging capabilities create new market opportunities and expand application possibilities.

Energy efficiency considerations in packaging and transportation favor lightweight barrier films over heavier traditional packaging materials. The ability of barrier films to provide equivalent or superior protection at lower weights supports adoption across applications focused on reducing transportation costs and environmental impact.

Consumer lifestyle changes including increased snacking, meal replacement products, and on-the-go consumption create demand for convenient packaging formats that rely heavily on barrier film technologies. Single-serve packaging and portion control applications require barrier films that maintain product quality in smaller package sizes.

Quality assurance requirements across industries drive adoption of barrier films that provide consistent, reliable protection. Manufacturing companies increasingly recognize that packaging failures can damage brand reputation and customer relationships, supporting investment in high-performance barrier solutions.

Innovation in active packaging systems incorporates barrier films with additional functionalities such as antimicrobial properties, oxygen absorption, and freshness indication. These advanced applications command premium pricing while creating new market segments and growth opportunities.

Other Trending Reports