Investors often seek ways to leverage their existing assets to obtain additional funds for various purposes. One such method is through the pledging of shares, a financial practice that allows individuals to secure loans using their shareholdings as collateral. In this article, we will explore the definition, process, advantages, and disadvantages of pledging shares.

Definition of Pledging Shares

Pledging shares refers to the act of using one’s shares in a company as collateral to obtain a loan from a financial institution. The shares are temporarily transferred to the lender as security, providing assurance that the borrower will repay the loan. The borrower retains ownership of the shares and continues to receive dividends and other benefits associated with shareholding.

The Process of Pledging Shares

The process of pledging shares typically involves the following steps:

- Identification of a suitable lender: Borrowers must find a financial institution that offers share pledging facilities.

- Loan application: The borrower submits an application to the lender, providing details of the shares to be pledged and the desired loan amount.

- Valuation of shares: The lender assesses the value of the shares to determine the loan amount that can be granted.

- Signing of agreement: Once the loan amount is finalized, both parties sign an agreement outlining the terms and conditions of the loan.

- Transfer of shares: The borrower transfers the shares to the lender’s demat account as collateral.

- Disbursement of funds: Upon successful transfer of shares, the lender disburses the loan amount to the borrower.

- Loan repayment: The borrower repays the loan amount along with any interest accrued within the agreed-upon timeframe.

- Release of shares: Once the loan is fully repaid, the lender releases the pledged shares back to the borrower.

How to Pledge Shares on Groww

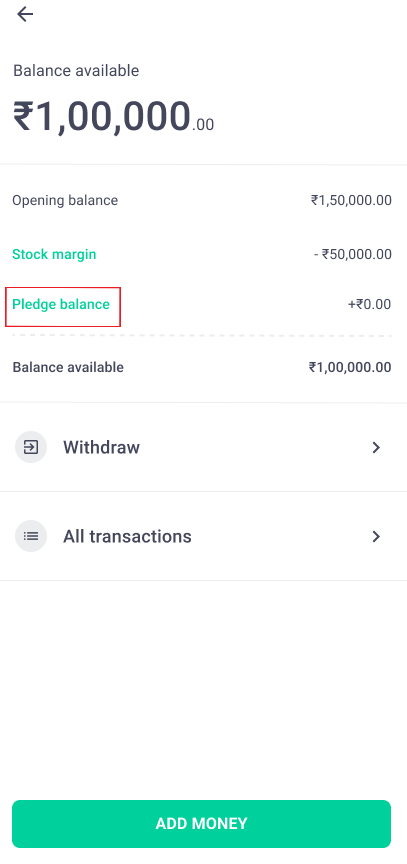

Step 1: Open your Groww Balance section and click on pledge balance.

You can also view access Pledge on Groww through your stock holdings.

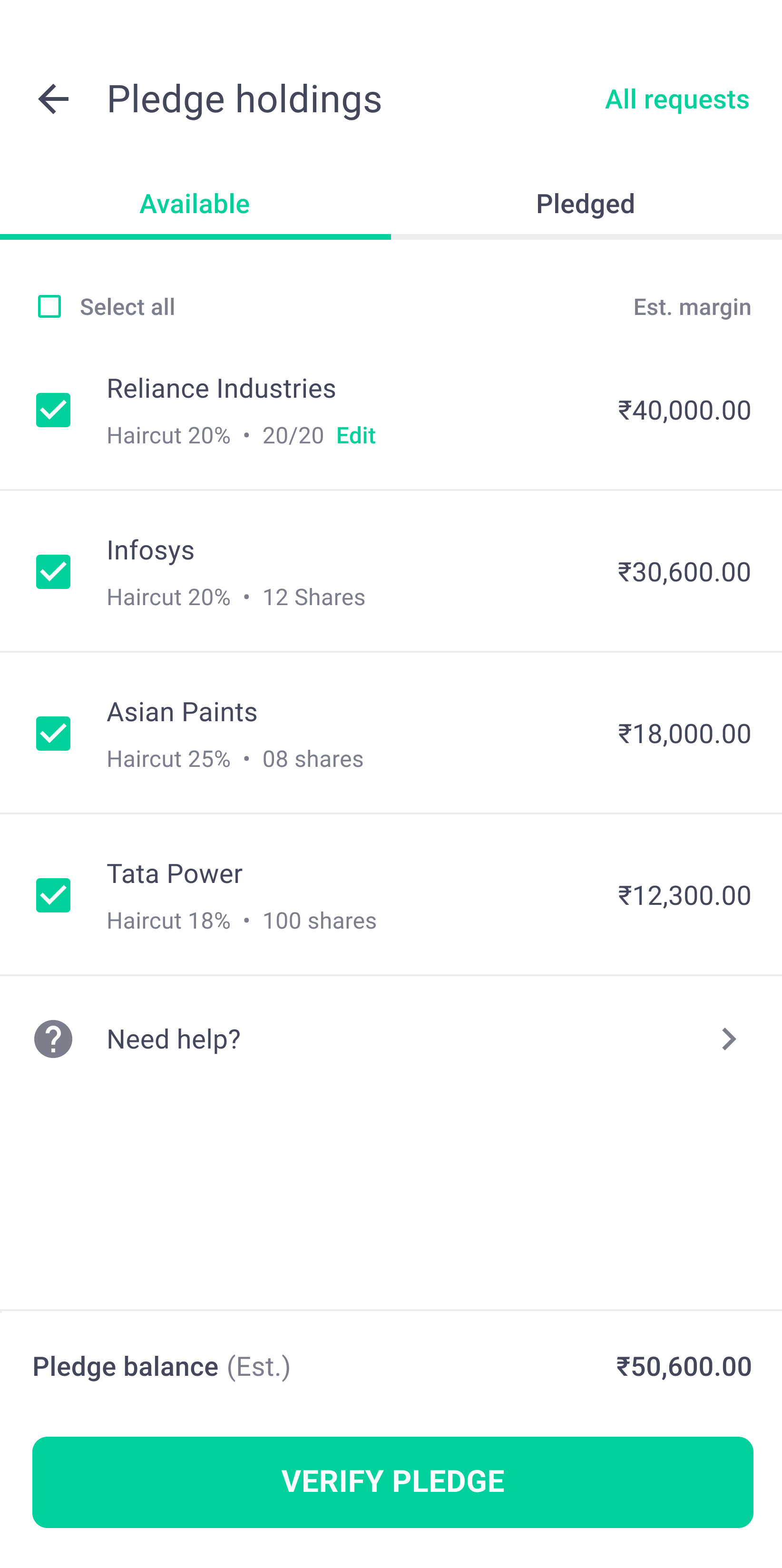

Step 2: All the stocks that are eligible for pledging from your holdings will be displayed. Choose which stock you want to pledge. Then click on the Verify Pledge button.

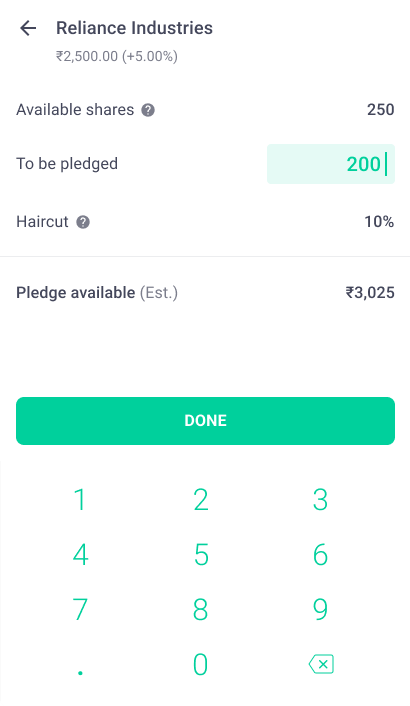

Step 3: You can edit the quantity of the stock you want to pledge. (Here you can see the total margin you will receive and the total haircut levied)

Note: No interest or charges will be applied to the usage of pledged margin.

Step 4: Click on the ‘Verify Pledge Button’. After clicking, you will be asked for an OTP. On filling in the OTP, you will be taken to another screen i.e. ‘All Request’. You can check your pledge status in the order details menu.

In Groww, you can use your pledged margin for the following:

- Option buying

- Option selling

- Futures

- Intraday

Advantages of Pledging Shares

Pledging shares can offer several advantages to investors:

- Quick access to funds: Pledging shares allows individuals to obtain funds quickly without selling their shares.

- Retaining ownership: Unlike selling shares, pledging shares allows borrowers to retain ownership and continue to benefit from any potential appreciation in share value.

- Flexibility in use of funds: Borrowers have the freedom to utilize the loan amount for various purposes, such as business expansion, personal expenses, or investment opportunities.

- Lower interest rates: Pledging shares often attracts lower interest rates compared to unsecured loans, making it a cost-effective financing option.

Disadvantages of Pledging Shares

While pledging shares can be beneficial, it also comes with certain disadvantages:

- Loss of control: Pledging shares means temporarily surrendering control of the shares to the lender, limiting the borrower’s ability to make decisions regarding those shares.

- Risk of share price depreciation: If the value of the pledged shares declines significantly, the lender may require additional collateral or demand repayment of the loan.

- Interest costs: Borrowers must bear the cost of interest on the loan, which can add to their financial obligations.

- Potential loss of dividends: In some cases, the borrower may lose the right to receive dividends on the pledged shares during the loan tenure.

Before opting for share pledging, individuals should carefully consider their financial situation, risk tolerance, and the terms offered by the lender. It is advisable to seek professional advice to understand the potential implications and make informed decisions.

In conclusion, pledging shares can be an effective way to access additional funds without selling one’s shares. However, it is essential to weigh the advantages and disadvantages and thoroughly understand the process before proceeding. With careful consideration and proper financial planning, pledging shares can serve as a valuable tool for investors seeking liquidity.