When you’re focused on growing your business, the last thing you want is for back-office inefficiencies to slow you down. One often-overlooked area where companies lose time and money is accounts payable (AP). If you’re still managing AP in-house, it may be time to ask:

Could outsourcing accounts payable actually accelerate your business growth?

Let’s explore how an experienced accounts payable services company can transform your financial operations and help you scale smarter in 2025 and beyond.

What Is Outsourced Accounts Payable?

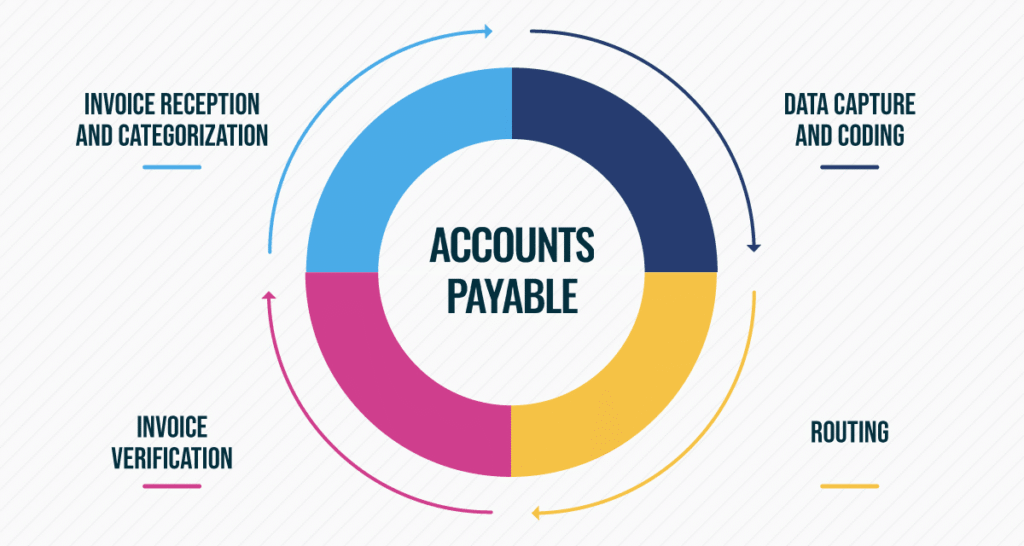

Outsourced accounts payable simply means hiring a third-party provider to handle your business’s invoice processing, payment approvals, vendor management, and compliance checks.

Think of it as delegating the time-consuming (yet critical) AP tasks to specialists, freeing your internal team to focus on strategic growth.

Why Is Outsourcing AP a Growth Strategy, Not Just a Cost-Cut?

Most companies initially consider outsourcing AP to reduce costs—but the real value lies in operational scalability and financial agility.

Here’s how outsourcing AP fuels business growth:

✅ Faster Invoice Processing = Better Cash Flow

Delayed payments can damage vendor relationships and skew your cash flow. An AP services company uses automation tools and streamlined workflows to:

- Process invoices in real time

- Flag errors instantly

- Prioritize early-payment discounts

- Improve cash forecasting

✅ Scalability Without Hiring More Staff

As your company grows, so do the invoices. Rather than expanding your finance team, an outsourced solution scales on-demand, eliminating hiring and training headaches.

✅ Improved Compliance & Audit Readiness

A professional AP partner ensures your processes align with:

- IRS documentation requirements

- SOX compliance

- Internal controls and segregation of duties

This keeps your business audit-ready while minimizing legal risk.

✅ Actionable Data for Strategic Decisions

Most AP service providers offer real-time dashboards and analytics—helping your team spot trends, control spend, and make faster, smarter financial decisions.

Common Questions About Outsourcing AP

Is Outsourcing AP Safe?

Absolutely—if you partner with a reputable accounts payable services company. At KMK Ventures, for instance, all processes follow strict confidentiality protocols, encrypted communications, and role-based access controls.

Will I Lose Control Over Payments?

No. You retain full control over approvals and payment releases. The AP partner simply manages the workflow so it’s cleaner, faster, and more accurate.

Can Outsourced AP Integrate With My ERP?

Yes! Most providers, including KMK Ventures, integrate with platforms like QuickBooks, NetSuite, SAP, Oracle, and others to ensure seamless data flow.

How to Choose the Right Accounts Payable Services Company?

When selecting an AP partner, look for:

- Industry experience

- Integration capabilities with your current tech stack

- Scalability to support your growth

- Transparent pricing with no hidden fees

- Proven compliance frameworks

Bonus Tip: Ask for client references and a sample workflow demo.

Final Thoughts: Is It Time to Rethink Your AP Process?

If your internal team is overwhelmed with manual invoice entry, vendor queries, or compliance challenges, it’s probably time to outsource.

The right accounts payable services company doesn’t just process bills—it becomes a growth partner that helps you:

- Operate leaner

- Move faster

- Plan better

- And scale with confidence