As digital finance continues to evolve, the line between traditional trading platforms and underground digital markets has sharpened awareness around cybersecurity, data privacy, and the value of information in online economies. One such marketplace that shaped discussions in this space is Fe-Shop—a well-known dark web platform that once facilitated the exchange of stolen financial data.

Though Fe-Shop operated outside the bounds of legality, it offers a valuable case study on how digital assets—whether ethical or illicit—are treated as tradable commodities in today’s information economy.

💡 What Was Fe-Shop?

fe-shop, often stylized as feshop, was an underground digital marketplace focused on the sale of:

- Stolen credit and debit card information

- Fullz (complete personal and financial identity packages)

- Online banking credentials

- Verified utility bills and documents used in fraud

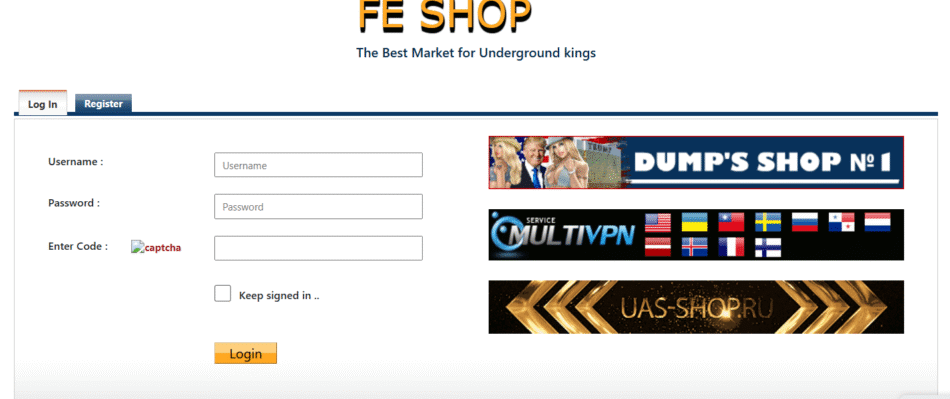

The platform ran much like a commercial trading site, offering categorized listings, buyer tools, filters by country and card type, and pricing models based on data quality and reliability.

While clearly illegal in its activity, Fe-Shop’s structure mirrored elements of legitimate trading platforms—giving us insight into how digital marketplaces operate at scale.

📊 Fe-Shop and the Trading Economy

Fe-Shop contributed to the broader digital trading economy by demonstrating how data, like stocks or crypto, can be segmented, priced, and traded. Here’s how its model resembled mainstream trading concepts:

- Supply & Demand Dynamics: High-quality financial records (especially U.S.-based fullz) were priced higher due to stronger demand.

- Real-Time Listings: Data inventory was updated regularly, similar to asset price updates in stock markets.

- Automated Payments: Purchases were made via cryptocurrencies like Bitcoin, allowing near-instant settlement across borders.

These parallels show how underground markets adapt legitimate trading models to operate within anonymous, decentralized environments.

🌐 Lessons for Legitimate Trading Platforms

Though unethical, Fe-Shop’s success highlights several important lessons for regulated platforms and cybersecurity professionals:

1. Market Trust Matters

Fe-Shop built a reputation system for sellers and buyers—reinforcing the idea that trust and transparency are essential, even in anonymous marketplaces.

2. UI and User Experience

Its interface was intuitive, with search filters, data previews, and instant delivery. This user-centric approach echoes best practices in fintech platforms, where ease of access drives user engagement.

3. Payment Innovations

The adoption of crypto payments and internal wallets prefigured trends in decentralized finance (DeFi), offering secure, borderless transactions—features now mirrored in legal trading apps and crypto exchanges.

🔐 Fe-Shop’s Role in Cybersecurity Awareness

Fe-Shop also played a role in raising awareness about:

- The tradeability of stolen data

- How financial data breaches are monetized

- Why digital trading platforms must integrate fraud prevention systems

Banks, fintech firms, and regulators learned from platforms like Fe-Shop to strengthen their security protocols, monitor suspicious behavior, and educate users about digital risks.

✅ Positive Impact on the Industry

While Fe-Shop was a threat in its time, its exposure and eventual takedown led to positive developments in the trading ecosystem:

- Improved fraud detection systems in banks and trading apps

- Faster response to large-scale data breaches

- Growing partnerships between cybersecurity firms and financial institutions

- Increased investment in ethical trading platforms and secure fintech products

🧭 Final Thoughts

Fe-Shop’s existence reminds us that data is a tradable asset—one that can be misused if not protected properly. But its story also drives the industry toward more robust, transparent, and secure trading environments.

For legitimate traders, developers, and cybersecurity professionals, platforms like Fe-Shop offer critical lessons in market behavior, trust mechanisms, and the economics of information—all of which can inform smarter, safer innovations in the legal trading world.

WhatsApp Us Now

WhatsApp Us Now