Introduction

The European blood screening market represents a critical component of the continent’s healthcare infrastructure, serving as the foundation for safe blood transfusions, organ transplants, and comprehensive disease diagnosis. This sophisticated market encompasses a wide range of testing technologies, methodologies, and products designed to detect infectious diseases, genetic disorders, and various health conditions through blood analysis. The market’s primary objective is to ensure the safety of blood supplies while providing accurate diagnostic information that supports clinical decision-making across diverse healthcare settings.

Blood screening in Europe operates under stringent regulatory frameworks that mandate comprehensive testing protocols for blood donations, ensuring the highest standards of safety for recipients. The market includes testing for major infectious diseases such as HIV, hepatitis B and C, syphilis, and other transmissible pathogens, as well as emerging threats that could compromise blood safety. Modern screening technologies employ multiple detection methods including nucleic acid testing, enzyme immunoassays, and chemiluminescent immunoassays to provide comprehensive pathogen detection with exceptional sensitivity and specificity.

The European blood screening market extends beyond traditional transfusion safety to encompass diagnostic applications in hospitals, clinical laboratories, and research institutions. This broader scope includes screening for autoimmune diseases, cancer markers, genetic conditions, and metabolic disorders that require sophisticated testing methodologies. The integration of advanced technologies such as automation, artificial intelligence, and molecular diagnostics has transformed blood screening from a manual, time-intensive process to a highly efficient, automated system capable of processing thousands of samples daily.

Healthcare systems across Europe rely on blood screening to maintain public health security while supporting various medical procedures that depend on safe blood products. The market serves multiple stakeholders including blood banks, hospitals, clinical laboratories, and regulatory authorities, each with specific requirements for testing accuracy, speed, and compliance with regional and international standards. The collaborative nature of European healthcare has fostered standardization efforts that promote interoperability and quality assurance across different healthcare systems.

The market’s evolution has been driven by technological advancement, regulatory requirements, and the continuous need to address emerging health threats. Recent developments include the implementation of pathogen reduction technologies, expanded screening panels, and the integration of point-of-care testing capabilities that enable rapid results in emergency situations. These innovations reflect the market’s commitment to advancing blood safety while adapting to evolving healthcare needs and technological capabilities.

The Evolution of Blood Screening in Europe

The history of blood screening in Europe began in the early 20th century when researchers first recognized the importance of blood typing for safe transfusions. The discovery of ABO blood groups by Karl Landsteiner in 1901 laid the foundation for modern blood banking and screening practices. Early screening methods were rudimentary, focusing primarily on blood compatibility testing to prevent immediate transfusion reactions without addressing the risk of infectious disease transmission.

The post-World War II era marked significant advancement in blood screening as healthcare systems recognized the need for more comprehensive testing protocols. The establishment of organized blood transfusion services across European countries led to the development of standardized screening procedures and quality control measures. During this period, screening expanded to include basic tests for syphilis and later hepatitis B as the understanding of transfusion-transmitted infections grew.

The 1980s brought a transformative period for blood screening in Europe with the emergence of HIV/AIDS, which highlighted the critical importance of comprehensive infectious disease screening. The HIV crisis prompted rapid development of screening technologies and regulatory frameworks designed to prevent transmission through blood transfusions. European countries implemented mandatory HIV testing for all blood donations, establishing the foundation for modern blood safety systems.

The 1990s witnessed the introduction of more sophisticated screening technologies, including enzyme-linked immunosorbent assays (ELISA) and later nucleic acid testing (NAT) methods. These advances significantly improved the sensitivity and specificity of pathogen detection while reducing the window period during which infections might go undetected. The implementation of NAT technology represented a major breakthrough, enabling direct detection of viral genetic material rather than relying solely on antibody responses.

The harmonization of European Union regulations during the 2000s led to standardized blood safety requirements across member states, promoting consistency in screening practices and quality standards. The European Medicines Agency (EMA) and other regulatory bodies established comprehensive guidelines for blood screening that continue to evolve with technological advances and emerging health threats.

The 2010s brought automation and high-throughput screening systems that revolutionized blood testing operations across Europe. Modern screening platforms can process thousands of samples per day with minimal human intervention, improving efficiency while reducing the risk of human error. The integration of laboratory information management systems (LIMS) has enabled better sample tracking, result reporting, and quality assurance throughout the screening process.

Recent years have seen the implementation of pathogen reduction technologies that complement traditional screening methods by inactivating pathogens in blood products. These technologies provide an additional layer of safety while addressing the limitations of screening-based approaches, particularly for emerging pathogens or variants that may not be detected by existing tests.

The COVID-19 pandemic has further accelerated innovation in blood screening, prompting the development of rapid testing methods and the integration of SARS-CoV-2 screening into routine blood safety protocols. This experience has demonstrated the importance of flexible, adaptable screening systems that can respond quickly to emerging health threats while maintaining existing safety standards.

Market Trends Shaping the European Blood Screening Industry

The European blood screening market exhibits several significant trends that reflect the evolving landscape of healthcare technology and regulatory requirements. Automation and digitalization have emerged as dominant trends, with laboratories increasingly adopting fully automated screening platforms that integrate sample processing, testing, and result reporting into streamlined workflows. These systems reduce manual intervention, minimize human error, and improve testing throughput while maintaining high accuracy standards.

Molecular diagnostics technologies are gaining prominence in European blood screening, with nucleic acid testing becoming the gold standard for pathogen detection. Advanced molecular methods, including real-time PCR, next-generation sequencing, and digital PCR, provide enhanced sensitivity and specificity while enabling simultaneous detection of multiple pathogens. These technologies support the trend toward comprehensive screening panels that can detect a wide range of infectious agents in single test runs.

Point-of-care testing capabilities are expanding across European healthcare systems, driven by the need for rapid results in emergency situations and remote locations. Portable blood screening devices enable testing at the bedside, in ambulances, and in resource-limited settings where traditional laboratory infrastructure may not be available. This trend supports improved patient care by reducing turnaround times and enabling faster clinical decision-making.

Artificial intelligence and machine learning applications are being integrated into blood screening workflows to enhance quality control, predict equipment maintenance needs, and optimize testing protocols. AI-powered systems can analyze screening results, identify patterns, and flag potential issues before they affect patient safety. These technologies also support predictive analytics that can anticipate blood supply needs and optimize inventory management.

Personalized medicine approaches are influencing blood screening practices, with expanded genetic testing and biomarker analysis becoming more common. European healthcare systems are implementing pharmacogenomic testing to guide medication selection, cancer screening programs that utilize blood-based biomarkers, and genetic screening for hereditary conditions. This trend reflects the broader shift toward precision medicine in European healthcare.

Regulatory harmonization continues to drive standardization across European countries, with efforts to align testing requirements, quality standards, and approval processes. The European Centre for Disease Prevention and Control (ECDC) and other regulatory bodies are working to establish common standards that facilitate cross-border collaboration while maintaining high safety standards.

Sustainability initiatives are increasingly important in the European blood screening market, with manufacturers developing eco-friendly reagents, reducing packaging waste, and implementing energy-efficient testing systems. These efforts align with broader European Union sustainability goals while addressing the environmental impact of healthcare operations.

The integration of blockchain technology is emerging as a trend for ensuring data integrity and traceability in blood screening operations. Blockchain systems can provide immutable records of testing results, sample handling, and quality control measures, enhancing transparency and accountability in blood safety systems.

Challenges Facing the European Blood Screening Market

The European blood screening market faces numerous challenges that impact healthcare systems, manufacturers, and patients across the continent. Regulatory complexity represents one of the most significant challenges, as blood screening products must comply with multiple overlapping regulations including the In Vitro Diagnostic Regulation (IVDR), Medical Device Regulation (MDR), and country-specific requirements. The implementation of IVDR has created substantial compliance burdens for manufacturers, requiring extensive clinical evidence and post-market surveillance systems.

Supply chain disruptions have become increasingly problematic, particularly following the COVID-19 pandemic, which highlighted vulnerabilities in global supply networks. Blood screening laboratories depend on specialized reagents, consumables, and equipment from international suppliers, making them susceptible to shortages and price fluctuations. These disruptions can compromise testing capacity and force laboratories to implement alternative testing strategies.

Skilled workforce shortages affect many European countries, as blood screening requires specialized technical expertise that is becoming increasingly scarce. The aging workforce in clinical laboratories, combined with the complexity of modern screening technologies, creates recruitment and retention challenges. Training programs struggle to keep pace with technological advances, leaving gaps in technical competency that can impact testing quality and efficiency.

Cost pressures continue to mount as healthcare systems face budget constraints while demands for testing increase. Blood screening represents a significant expense for healthcare systems, requiring substantial investments in equipment, reagents, and personnel. The need to balance cost control with safety requirements creates ongoing tension that affects purchasing decisions and service delivery.

Emerging pathogen threats pose continuous challenges for blood screening systems, as new infectious agents or variants of existing pathogens may not be detected by current testing methods. The development of screening tests for emerging threats requires time and resources, creating temporary vulnerabilities in blood safety systems. Recent examples include novel coronavirus variants and emerging tick-borne diseases that require updated screening protocols.

Technology integration challenges arise as laboratories attempt to incorporate new testing platforms into existing workflows. Legacy systems may not be compatible with modern equipment, requiring costly infrastructure upgrades or parallel testing systems. The integration of different manufacturers’ equipment and software can create technical difficulties that impact laboratory efficiency and data management.

Quality control and standardization remain ongoing challenges as laboratories must maintain consistent testing quality across different platforms, reagents, and personnel. Inter-laboratory variability can affect test results and compromise patient safety, requiring robust quality assurance programs and external proficiency testing. The harmonization of testing standards across different European countries adds complexity to quality management efforts.

Data management and cybersecurity concerns are increasing as blood screening systems become more digitized and interconnected. Laboratories must protect sensitive patient data while ensuring system availability and reliability. Cybersecurity threats can compromise testing operations and patient privacy, requiring substantial investments in security measures and staff training.

Reimbursement challenges affect the adoption of new screening technologies, as healthcare systems may be reluctant to fund expensive new tests without clear evidence of cost-effectiveness. The reimbursement approval process can be lengthy and complex, delaying the implementation of beneficial technologies and creating financial pressures on healthcare providers.

Market Scope and Applications

The European blood screening market encompasses a comprehensive range of applications across multiple healthcare settings, each requiring specific testing capabilities and regulatory compliance. Blood bank screening represents the largest application segment, encompassing mandatory testing of all blood donations for infectious diseases including HIV, hepatitis B and C, syphilis, and other transmissible pathogens. This segment operates under strict regulatory requirements that mandate comprehensive testing protocols to ensure blood safety for transfusion recipients.

Hospital-based screening applications include pre-transfusion testing, surgical screening, and emergency diagnostics that require rapid turnaround times and high accuracy. Hospital laboratories must maintain capability for urgent testing while integrating with blood bank systems to ensure compatibility and safety. These applications often require point-of-care testing capabilities for immediate results in critical situations.

Clinical laboratory screening serves diagnostic purposes beyond transfusion safety, including screening for autoimmune diseases, cancer markers, genetic conditions, and metabolic disorders. These applications require sophisticated testing methodologies and specialized expertise to interpret complex results and provide clinical recommendations. The diagnostic screening segment continues to expand as new biomarkers and testing methods become available.

Organ and tissue transplant screening requires specialized testing protocols to assess donor-recipient compatibility and screen for transmissible diseases. This application demands extremely high sensitivity and specificity due to the immunocompromised status of transplant recipients. Transplant screening often requires rapid testing capabilities to support time-sensitive procedures while maintaining comprehensive safety standards.

Prenatal and genetic screening applications utilize blood-based tests to detect chromosomal abnormalities, genetic disorders, and maternal health conditions. These applications require specialized testing methodologies and genetic counseling support to ensure appropriate test interpretation and patient counseling. The expanding scope of prenatal screening reflects advances in genetic testing technologies and changing healthcare practices.

Occupational health screening serves workplace safety programs and healthcare worker monitoring, particularly for exposure to bloodborne pathogens. This application requires standardized testing protocols and confidential result reporting to support employee health and safety programs. Occupational screening often involves periodic testing and vaccination monitoring for healthcare workers.

Research and surveillance applications support public health monitoring, epidemiological studies, and biomedical research. These applications require specialized testing capabilities and data management systems to support research objectives while maintaining participant privacy and data security. Research screening often involves experimental testing methods and novel biomarkers.

Quality control and proficiency testing applications ensure testing accuracy and regulatory compliance across all screening activities. These applications require reference materials, standardized protocols, and external validation to maintain testing quality and support regulatory requirements. Quality control represents a critical component of all blood screening operations.

Emergency preparedness applications include screening capabilities for disaster response, mass casualty events, and public health emergencies. These applications require portable testing equipment, rapid deployment capabilities, and surge capacity planning to support emergency healthcare needs. Emergency screening systems must maintain safety standards while providing rapid results under challenging conditions.

Market Size and Growth Projections

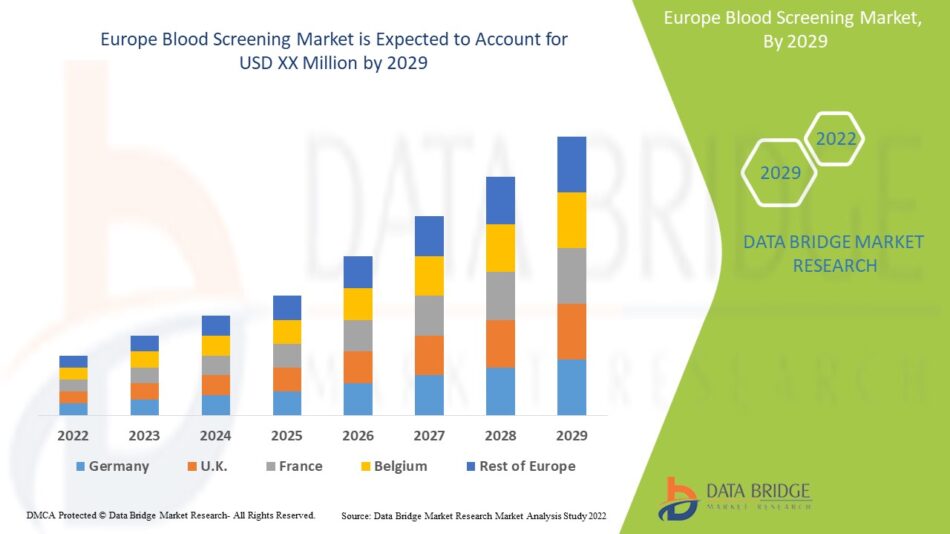

The European blood screening market has achieved substantial scale, reflecting the comprehensive healthcare infrastructure and mandatory testing requirements across the continent. Market research indicates steady growth driven by aging populations, increasing healthcare utilization, and expanding screening requirements for emerging pathogens. The market encompasses multiple testing segments with varying growth rates based on technological advancement, regulatory changes, and healthcare demand patterns.

Current market valuations reflect the diverse applications of blood screening across healthcare systems, with infectious disease screening representing the largest segment due to mandatory testing requirements for blood donations. The diagnostic screening segment shows strong growth potential as healthcare systems expand screening programs for chronic diseases and genetic conditions. Molecular diagnostics technologies command premium pricing due to their superior performance characteristics and comprehensive testing capabilities.

Regional market distribution within Europe shows significant variation based on healthcare infrastructure, population demographics, and regulatory frameworks. Western European countries including Germany, France, and the United Kingdom represent the largest markets due to their advanced healthcare systems and high healthcare expenditure. These markets demonstrate mature screening infrastructure with emphasis on technological advancement and efficiency improvements.

Nordic countries exhibit strong market growth driven by government healthcare investments and emphasis on preventive care. These markets often lead in adopting new technologies and implementing comprehensive screening programs. The focus on digitalization and automation in Nordic healthcare systems creates opportunities for advanced screening technologies.

Eastern European markets show rapid growth as healthcare infrastructure modernizes and regulatory alignment with European Union standards accelerates. These markets present opportunities for manufacturers seeking to expand their presence while requiring solutions that address cost constraints and infrastructure limitations. The expansion of healthcare coverage in these regions drives increased screening demand.

Southern European markets demonstrate steady growth with emphasis on cost-effective solutions and public health programs. These markets often prioritize value-based procurement and standardized testing protocols to optimize healthcare spending while maintaining safety standards. The focus on standardization creates opportunities for manufacturers offering comprehensive solutions.

Market size projections for the coming years indicate continued growth across all major segments and regions. The aging European population and increasing prevalence of chronic diseases are expected to drive sustained demand for screening services. Technological advances in molecular diagnostics and automation are anticipated to create new market opportunities while improving testing efficiency and accuracy.

Investment in research and development continues to increase as manufacturers seek to develop innovative products that address evolving healthcare needs. This investment focuses on emerging pathogen detection, personalized medicine applications, and point-of-care testing capabilities. The continued innovation in blood screening technology is expected to drive market growth and create competitive advantages for leading manufacturers.

The market outlook remains positive despite challenges related to regulatory compliance, cost pressures, and supply chain disruptions. The essential nature of blood screening in healthcare delivery provides fundamental demand support, while ongoing technological innovation creates opportunities for market expansion and improved patient outcomes.

Factors Driving Growth in the European Blood Screening Market

The European blood screening market experiences robust growth driven by multiple interconnected factors that reflect the evolving healthcare landscape and technological capabilities. Demographic changes, particularly the aging population across Europe, represent a fundamental driver as older individuals require more medical procedures involving blood transfusions and diagnostic testing. The increasing prevalence of chronic diseases associated with aging creates sustained demand for screening services across all healthcare settings.

Regulatory requirements for blood safety continue to drive market growth as European authorities expand mandatory testing protocols and implement more stringent safety standards. The implementation of new regulations, including updates to address emerging pathogens and improved testing methodologies, creates demand for advanced screening technologies and compliance systems. These regulatory drivers ensure consistent market demand while promoting innovation in testing capabilities.

Technological advancement in molecular diagnostics has revolutionized blood screening capabilities, enabling more sensitive and specific pathogen detection while reducing testing times. The development of multiplex testing platforms that can simultaneously detect multiple pathogens has improved testing efficiency and cost-effectiveness. These technological improvements drive market growth by enabling laboratories to expand their testing capabilities while reducing operational costs.

Healthcare infrastructure modernization across Europe has created opportunities for implementing advanced screening technologies and automated systems. Government investments in healthcare infrastructure and laboratory capabilities have supported the adoption of high-throughput screening platforms and digital health technologies. This infrastructure development creates demand for modern screening equipment and systems.

Emerging pathogen threats continue to drive innovation and investment in blood screening technologies. The COVID-19 pandemic highlighted the importance of flexible, adaptable screening systems that can respond quickly to new threats while maintaining existing safety standards. The need to address emerging infectious diseases creates ongoing demand for research and development in screening technologies.

Quality improvement initiatives in healthcare systems drive adoption of advanced screening technologies that provide better accuracy, reliability, and traceability. Healthcare providers seek screening solutions that can improve patient outcomes while reducing the risk of adverse events. These quality initiatives create demand for premium screening products and services.

Cost-effectiveness pressures in healthcare systems drive demand for automated, high-throughput screening systems that can reduce per-test costs while maintaining quality standards. The need to balance cost control with safety requirements has accelerated adoption of efficient screening technologies and consolidated testing operations. These economic drivers create opportunities for manufacturers offering comprehensive, cost-effective solutions.

Preventive healthcare initiatives across Europe have expanded screening programs for early disease detection and prevention. Government health programs and clinical guidelines increasingly recommend routine screening for various conditions, creating sustained demand for testing services. These preventive care initiatives represent a significant growth driver for the diagnostic screening segment.

Research and development investment continues to accelerate as manufacturers and healthcare institutions seek to develop innovative screening technologies. European research programs, including Horizon Europe and national research initiatives, provide funding for developing next-generation screening technologies. This research investment drives innovation and creates new market opportunities.

Cross-border healthcare initiatives within the European Union have created demand for standardized screening protocols and interoperable systems. The need to support patient mobility and healthcare collaboration across countries drives standardization efforts and creates opportunities for manufacturers offering EU-wide solutions.

Digital health transformation initiatives across European healthcare systems have created demand for integrated screening solutions that support electronic health records, telemedicine, and data analytics. The digitalization of healthcare creates opportunities for screening technologies that integrate with broader digital health platforms.

Public health preparedness requirements have increased investment in screening capabilities for emergency response and disease surveillance. The need to maintain surge capacity and rapid response capabilities drives demand for flexible, scalable screening systems that can support public health objectives while maintaining routine healthcare services.

Patient safety initiatives continue to drive demand for advanced screening technologies that provide comprehensive pathogen detection and risk assessment. Healthcare providers seek screening solutions that can minimize transfusion-related complications while supporting evidence-based treatment decisions. These safety initiatives create sustained demand for high-quality screening products and services.

Other Trending Reports

WhatsApp Us Now

WhatsApp Us Now