Introduction

The futures market can feel like a wild roller coaster ride, filled with unpredictable twists and turns. For traders looking to navigate this volatility, having the right strategies is crucial. Whether you’re an experienced pro or just dipping your toes into trading waters, understanding how to analyze market movements can set you apart from the crowd.

Imagine being able to make informed decisions based on real-time data rather than relying solely on gut feelings. What if you could tap into dealer-level insights and harness multi-asset trade setups? The good news is that these tools are now more accessible than ever. Join us as we explore key strategies for futures market analysis effectively. With the right approach, you’ll not only survive but thrive in today’s fast-paced trading environment.

The Importance of Market Analysis for Successful Trading

Market analysis is the backbone of informed trading decisions. It allows traders to understand price movements and trends, providing a clearer picture of potential opportunities. Without proper analysis, traders may fall prey to emotions or market noise.

This can lead to hasty decisions that result in losses rather than gains. Understanding market dynamics helps in identifying patterns and signals that indicate future price actions. By studying historical data and current conditions, traders gain valuable insights into what drives asset values.

Moreover, effective analysis enables risk management. Knowing when to enter or exit positions reduces exposure during volatile periods.

With the right analytical tools at your disposal, you can navigate the complexities of trading with confidence. A solid grasp on market forces sets successful traders apart from those who rely solely on instinct or guesswork.

Utilizing Dealer-Level Insights for Strategic Decision Making

Dealer-level insights serve as a crucial asset for traders navigating the complexities of the futures market. These insights come directly from those with their fingers on the pulse of market movements, offering clarity where noise often prevails.

By tapping into these data points, traders gain an edge in understanding supply and demand dynamics. This knowledge helps identify potential price shifts before they become apparent to the broader market.

Furthermore, leveraging dealer sentiment can reveal underlying trends that may not be visible through traditional analysis methods. It’s about knowing what large players are doing and aligning your strategies accordingly.

With this information at hand, decisions transform from guesswork to informed actions. The ability to interpret dealer signals is invaluable in enhancing trading performance amidst volatility.

Real-Time Positioning and Its Impact on Trading Performance

Real-time positioning is a game-changer in the trading landscape. It allows traders to gauge market sentiment and react swiftly to price movements. By tracking positions as they evolve, you gain insights into how other market participants are positioned.

This information can significantly influence your decisions. Understanding where large players are placing their bets can provide clues about potential turning points or trends. You’re not just trading in isolation; you’re engaging with a dynamic ecosystem of buyers and sellers.

Moreover, timely data helps reduce emotional trading. When you have clear visibility on current positions, it minimizes guesswork and fosters confidence in your strategies. The ability to adapt quickly becomes invaluable during volatile market conditions.

Harnessing real-time tools ensures that you’re always one step ahead, optimizing your entries and exits for maximum effectiveness. Having this edge could be what separates successful trades from missed opportunities.

Maximizing Trade Setups with Multi-Asset Analysis

Maximizing trade setups involves looking beyond a single asset. Multi-asset analysis opens up new opportunities by revealing correlations and divergences across various markets.

By examining different assets together, traders can identify trends that might not be visible in isolation. For instance, movements in commodities can influence currency values or stock prices. Understanding these relationships is crucial for informed decision-making.

Additionally, multi-asset strategies allow for better risk management. Diversifying trades across multiple instruments reduces exposure to any one market’s volatility. This balanced approach enhances the potential for gains while minimizing risks.

Implementing this strategy also encourages adaptability. Traders who monitor different assets are more equipped to respond swiftly to market changes, adjusting their positions based on real-time information rather than rigid plans.

Incorporating multi-asset analysis into your trading routine can transform how you approach the market significantly. The insights gained will empower more effective trading decisions over time.

Joining an Elite Discord Community for Professional Trading Support

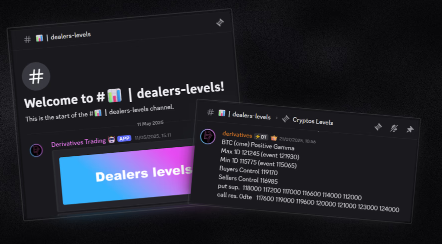

Joining an elite Discord community can transform your trading experience. Here, you’ll find a diverse group of traders who share insights and strategies.

The real-time interaction fosters immediate feedback on market trends. This dynamic environment encourages learning from both successes and mistakes. You gain access to discussions that go beyond basic analysis.

Moreover, the community often shares dealer-level insights that are hard to come by elsewhere. These nuggets of information can provide a competitive edge in volatile markets.

Networking within this circle opens doors to collaboration and mentorship opportunities. You’re not just trading alone; you’re part of a collective focused on growth.

With dedicated channels for different asset classes, you’ll always stay informed about what matters most in your trades. The support system is invaluable when navigating uncertain waters in the futures market.

Why Data is Key: Overcoming Noise in the Market

In the fast-paced world of trading, data is your most valuable asset. It cuts through the chaos and reveals patterns that noise often obscures. With a wealth of information at your fingertips, you can make informed decisions rather than reacting impulsively.

Market fluctuations create a cacophony of opinions and predictions. Traders may find themselves overwhelmed by headlines or social media chatter. Focusing on solid data allows you to sidestep this confusion and concentrate on what truly matters: actionable insights.

Utilizing analytical tools helps pinpoint trends, entry points, and exits with precision. By analyzing historical performance alongside current metrics, you’re equipped to navigate uncertainty confidently.

This disciplined approach fosters resilience in volatile times. The reliance on hard facts over speculation transforms how you engage with the market. Embrace data as an ally—it’s essential for mastering volatility while reducing emotional strain in your trading journey.

Upgrading Your Trading Journey with Derivatives Trading

Upgrading your trading journey starts with embracing derivatives trading. This method offers immense flexibility, allowing you to hedge risks while amplifying potential returns.

With instruments like futures and options, traders can gain exposure to various markets without needing substantial capital upfront. The leverage involved means even modest price movements can lead to significant profits or losses.

Moreover, derivatives provide strategic avenues for diversification across asset classes. You’re not limited to one market; instead, you can explore commodities, currencies, and indices all in one go.

To truly maximize this approach, staying informed is key. Accessing real-time data ensures you’re making decisions based on current market dynamics rather than outdated information.

Engagement within a community focused on derivatives enhances learning opportunities as well. Sharing insights and strategies with fellow traders allows for growth and adaptation in an ever-changing environment.

Conclusion

Navigating the complexities of the futures market requires a strategic approach and informed decision-making. By utilizing dealer-level insights, you can gain an edge in understanding market dynamics. Real-time positioning is crucial, as it allows traders to adapt swiftly to changing conditions, ultimately improving performance.

Data-driven trading strategies are essential for cutting through the noise that often obscures clarity in volatile markets. Information empowers you to make decisions based on facts rather than emotions or speculation.

Upgrading your trading journey with Derivatives Trading provides access to tools and insights that elevate your skills from novice to professional level. Engaging with experienced traders helps refine techniques while enhancing confidence in executing trades effectively.

Embracing these strategies positions you well for long-term success in the futures market. As volatility persists, staying informed and connected will be key components in navigating this dynamic landscape successfully.

WhatsApp Us Now

WhatsApp Us Now