Understanding Third-Party Administration in Modern Healthcare

Healthcare management has evolved significantly in recent years, with third-party administrators playing a crucial role in bridging the gap between insurance providers and policyholders. The complexity of modern healthcare systems demands specialized expertise in claims processing, network management, and customer service delivery. Organizations that specialize in these services have become indispensable partners for insurance companies seeking to streamline operations while maintaining high standards of member satisfaction and regulatory compliance.

Comprehensive Coverage Through Life Line Insurance Solutions

When it comes to securing your family’s health and financial future, life line insurance offers a safety net that extends beyond basic coverage. The insurance landscape in the Middle East has matured considerably, with policyholders now expecting transparent communication, efficient claims processing, and seamless access to quality healthcare providers. Modern insurance administration requires sophisticated systems capable of handling thousands of claims daily while maintaining accuracy and compliance with local regulations. The integration of technology with experienced medical professionals ensures that every claim receives appropriate attention, whether it involves routine medical care or complex treatment scenarios requiring specialized review.

Excellence in Lifeline Insurance UAE Market

The lifeline insurance uae sector has witnessed remarkable growth driven by mandatory health insurance regulations and increasing health awareness among residents. Companies operating in this space must navigate complex regulatory frameworks while delivering exceptional service quality across diverse demographics. The United Arab Emirates health insurance market presents unique challenges including multi-cultural populations, varying coverage requirements across emirates, and the need for multilingual support services. Successful administration requires deep understanding of local healthcare ecosystems, established relationships with medical providers, and robust technological infrastructure capable of processing claims in real-time while preventing fraud and abuse.

Growing Opportunities in TPA Careers Development

The expanding healthcare administration sector has created numerous tpa careers opportunities for professionals passionate about making a difference in people’s lives. Career paths within third-party administration span multiple disciplines including medical coding, claims adjudication, customer service, network management, and healthcare analytics. Professionals in this field benefit from continuous learning opportunities, exposure to cutting-edge healthcare technology, and the satisfaction of helping members navigate complex insurance processes. The industry rewards individuals who combine technical expertise with genuine empathy for members facing health challenges. Organizations committed to staff development invest heavily in training programs covering medical terminology, insurance regulations, claims processing systems, and customer service excellence.

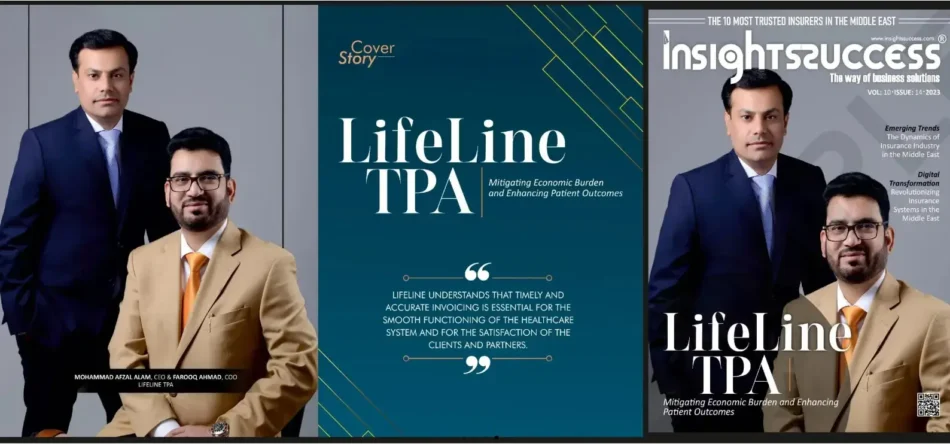

The Lifeline TPA Advantage in Healthcare Management

As a distinguished lifeline tpa service provider, the organization has built its reputation on delivering consistent excellence across all touchpoints of the insurance experience. With operations spanning the UAE, Oman, and Turkey since 2015, the company has processed millions of claims while maintaining industry-leading accuracy rates and member satisfaction scores. The comprehensive service portfolio includes intelligent claims processing powered by sophisticated adjudication rules, 24/7 customer support through dedicated call centers, and extensive provider networks offering cashless access to quality healthcare facilities. Strategic partnerships with leading insurance companies and healthcare providers enable the delivery of seamless experiences for individual, family, group, and corporate clients.

Intelligent Claims Processing and Management Systems

Modern claims administration relies on advanced technology platforms capable of automating routine decisions while flagging complex cases for expert review. The implementation of thousands of adjudication rules enables automatic processing of over 80 percent of claims without manual intervention, significantly reducing turnaround times while maintaining accuracy. This intelligent approach combines rules-based automation with experienced medical professionals who review exceptions, ensuring appropriate care authorization while controlling costs through effective utilization management. The systems incorporate fraud detection algorithms, duplicate claim identification, and eligibility verification to protect insurance company interests while ensuring legitimate claims receive prompt payment.

Network Management and Provider Relations

A robust provider network forms the foundation of quality healthcare access for insurance members. Effective network management involves credentialing healthcare facilities, negotiating competitive rates, monitoring quality metrics, and ensuring geographic coverage across service areas. The establishment of cashless facility arrangements with hospitals, clinics, pharmacies, and diagnostic centers eliminates financial barriers to care while streamlining the reimbursement process. Regular provider education ensures understanding of coverage policies, authorization requirements, and claims submission procedures, reducing administrative burden and improving the member experience.

Customer Service Excellence and Member Support

Healthcare can be confusing and stressful, making responsive customer service essential to member satisfaction. Round-the-clock availability through call centers, online portals, and mobile applications ensures members receive timely assistance regardless of when needs arise. Well-trained customer service representatives combine technical knowledge with empathy, helping members understand benefits, locate network providers, check claim status, and resolve concerns efficiently. The commitment to clear, honest, and open communication builds trust while reducing confusion about coverage details, authorization requirements, and out-of-pocket responsibilities.

Wellness Programs and Preventive Care Initiatives

Forward-thinking insurance administrators recognize that prevention is more effective and economical than treating advanced disease. Comprehensive wellness programs encourage healthy behaviors through health risk assessments, biometric screenings, chronic disease management, and lifestyle coaching. Digital tools including mobile apps and online portals empower members to track health metrics, schedule preventive screenings, and access educational resources about nutrition, exercise, stress management, and disease prevention. These initiatives benefit all stakeholders by improving population health, reducing serious illness rates, and controlling long-term healthcare costs.

Strategic Partnerships and Long-Term Value Creation

Success in healthcare administration requires collaborative relationships built on mutual trust and shared objectives. Strategic alliances with insurance partners, healthcare providers, and corporate clients create value through aligned incentives, shared data insights, and coordinated care delivery. The focus on long-term partnerships rather than transactional relationships enables continuous improvement through feedback loops, joint problem-solving, and innovation in service delivery models. This approach has enabled sustained growth while maintaining the quality standards that distinguish industry leaders from commodity providers.

Commitment to Transparency and Ethical Operations

Healthcare involves deeply personal information and significant financial stakes, making transparency and ethical conduct non-negotiable requirements. Clear communication about coverage details, authorization decisions, and claim determinations builds member confidence while reducing disputes. Effective controls on abuse and fraud protect insurance company assets without creating unnecessary obstacles for members seeking legitimate care. The commitment to doing what is right rather than merely what is expedient has earned trust among insurance partners, healthcare providers, and the members whose health and financial security depend on reliable administration.

Future Vision and Continuous Innovation

The healthcare landscape continues evolving with technological advances, changing demographics, and shifting regulatory requirements. Organizations positioned for long-term success invest in innovation while maintaining core service quality. The vision extends beyond current markets to potential expansion opportunities where expertise in managed care, health risk management, and consulting services can improve healthcare access and affordability. Continuous improvement through staff training, technology upgrades, and process optimization ensures readiness to meet tomorrow’s challenges while exceeding today’s expectations.

Lifeline TPA stands as a trusted partner in healthcare management, delivering excellence through experienced professionals, advanced technology, and unwavering commitment to member satisfaction.

WhatsApp Us Now

WhatsApp Us Now